Fees matter.

March 28, 2016

Costs Have Consequences.

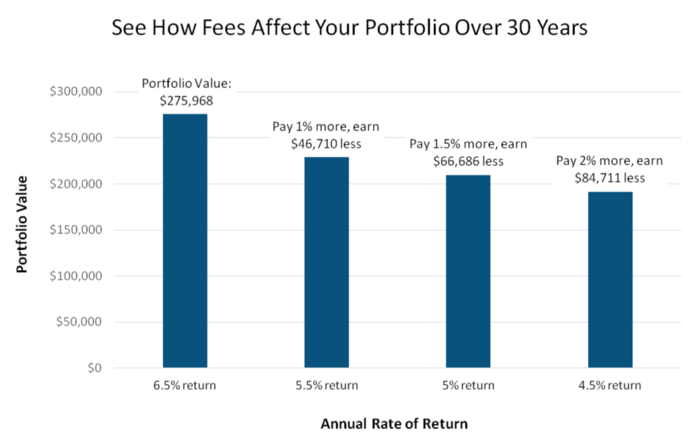

Every dollar you pay in fees and trading commissions is money that will never go to work for you. And the value of those lost dollars compounds over time.

Even 1% can make a big difference — you could earn 20% more by paying 1% less.

According to the Department of Labor, a 1% reduction in plan fees could lead to a 28% increase in a participant’s retirement account balance.1

Let’s assume that you are an employee with 35 years until retirement and a current 401(k) account balance of $25,000. If returns on investments in your account over the next 35 years average 7 percent and fees and expenses reduce your average returns by 0.5 percent, your account balance will grow to $227,000 at retirement, even if there are no further contributions to your account. If fees and expenses are 1.5 percent, however, your account balance will grow to only $163,000.

You could be losing hundreds of thousands of dollars in hidden fees in your mutual fund, investing and retirement accounts. Financial institutions charge annual fees (also known as custodial fees, inactivity fees, or 12b-1 fees) on mutual funds and other assets. Over time, these fees add up and can dramatically reduce your lifetime savings.

Even no-load mutual funds aren’t free. When you invest in a fund, the management and operational costs (this is called the fund’s expense ratio) are taken directly out of your returns as an asset-based fee. The average expense ratio of stock mutual funds is about 1.37%.

But mutual fund costs don’t stop there. Funds are not required to report their trading costs to investors, and as a result, investors are subject to additional “invisible” fees. A recent study published by the Financial Analysts Journal and reported on in U.S. News and World Report estimates that investors pay an average of 1.44% per year in trading costs on top of the expense ratios. That makes the combined total average cost of owning a mutual fund almost 2.81% per year!

1. Deparment of Labor Study- A look at 401(k) Plan Fees.

Get the latest from Qmulate

You can unsubscribe at any time. Read our privacy policy