Market Timing & Disciplined Investing.

May 23, 2016

If you invest consistently — such as by adding a steady dollar amount to your investments regardless of what the market is doing — you free yourself from worrying about when the best time is to invest, and you’ll likely invest more overall. You won’t be “chasing performance”, instead you’ll be investing smarter.

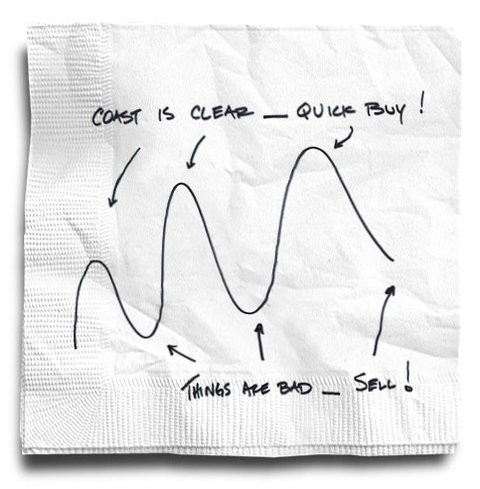

Investors typically buy and sell at the wrong time. When the market is on the up swing, they buy, and when they think the market is tanking, they sell.¹ Many investors chase high-performing funds, stocks and “hype”. The amount of wealth lost through bad timing and poor decisions is mind-blowing.

This is not a good strategy.

An example of how bad timing cost investors:

10-year average return of all mutual funds (stock and bond): 7.3%

10-year average return generated by mutual fund investors: 4.8%

10-year average for fund investor underperformance: 2.5%²

Other researchers estimate mutual fund investor underperformance at even higher rates — as much as 4% annually³ — all from bad timing.

Behavioral biases.

Naturally, when one sees or hears about a stock/fund appreciating substantially, it will elicit an emotional reaction about how your portfolio is performing. At first, you feel like you lost an opportunity to own this and increase your gains. You may even feel that you should have seen this coming. You wonder why you didn’t buy it at what is now considered to be a “low price” several months ago?

You continue to think about this stock or fund as you see the price continuosly go up. Until finally, of course, you have to get in on it and you buy. At this point, it’s run up more than 25%. Over the next few weeks, the stock/fund continues to rise You’re feeling good that you bought it. Then, as all good things do, it comes to an end. The stock/fund starts to drop drastically. Your stomach is in knots. Now you begin to regret acting so hastily to buy it. You feel that you should have know after a 25% run that it should be coming to an end.

You convince yourself it’s a good investment, so you hold on to it. Finally, you watch all of your gains disappear as the stock/fund completely reverse course. Now you are reluctant to sell because you don’t want to take a loss; it’s hard enough to see it on paper. It’s human nature to have these emotions, but when you act on them, it can be devastating to your overall wealth accumulation.

The time to buy is typically when nobody else wants to but that is a hard road to travel. It is far safer and simpler to stay the course and invest consistently.

1. 2014 DALBAR QAIB Highlights Futility of Investor Education (Dalbar)

2. Bad Timing Costs Investors 2.5% a Year (Morningstar)

3. 2014 DALBAR QAIB Highlights Futility of Investor Education (Dalbar)

Get the latest from Qmulate

You can unsubscribe at any time. Read our privacy policy