A retirement plan made just for you.

As a business owner, freelancer or independent contractor without employees, a Solo 401(k) can help you save more than a Traditional, Roth or SIMPLE IRA.

Get Started

The benefits of working for yourself.

As a business owner, you have the best of both worlds with a solo 401(k). The flexibility to contribute much more from year-to-year (up to the standard limits), plus, you can also set aside money as an employee throughout the year. You also get all the benefits of traditional 401(k) plans such as tax deductions and loans.

Higher contribution limits

The total solo 401(k) contribution limit is up to $58,000 in 2021. There is a catch-up contribution of an extra $6,500 for those 50 or older.

Diverse investment options

The funds in our managed portfolios are globally diverisified for optimal performance.

Loans available

Tax-free loans offer access to money in case of emergency.

Tax breaks

Traditional 401(k) contributions (employee and employer share) are made pre-tax, reducing taxable income for the year.

Because there are no employees, plan administration is extremely low maintenance. Owners are not required to file annual reports with the IRS until the plan reaches $250,000 in assets.

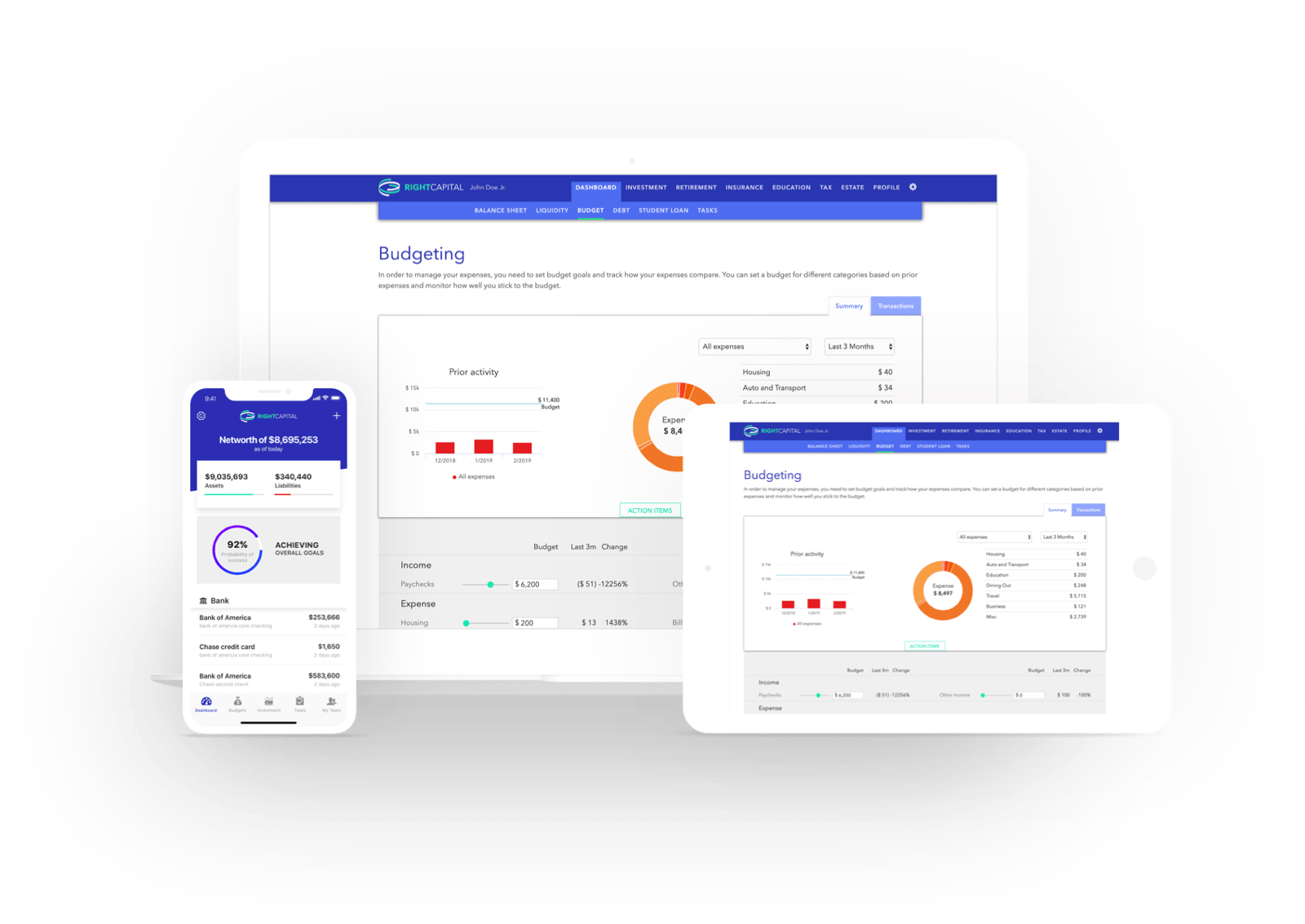

Your financial life, all in one place.

You can sync and track all your financial data, goals and investment accounts at any time as well as check your performance.

We’ll also examine your portfolio and provide tips on how to improve your investment strategy.

Some FAQs

A solo 401(k) is a retirement savings plan for a self-employed or sole proprietor business owner (and spouse, if applicable). No w2 employees are allowed.

Roth could make sense for employees if their tax bracket will be the same or higher in retirement than it is currently. This usually applies to younger employees who are early in their careers. Income contributed to a Roth 401(k) is taxable the year in which it is earned, while earnings and interest gains remain untaxed even upon withdrawal.

Employers are allowed to match a Roth plan; however, employer contributions cannot receive Roth tax treatment and must be allocated to a pre-tax account, usually a Traditional 401(k).

A solo 401(k) plan provides all the same benefits as their larger, traditional 401(k) counterparts–acting as a savings vehicle for participants to invest contributions from their paychecks.

By playing both roles as both employer and employee, solo 401(k) plans allow self-employed business owners to maximize their retirement contributions. Solo business owners can then gain additional savings by deducting these 401(k) contributions, along with any plan costs, as a business expense.

A self-employed business owner must have earned income from self-employment to contribute to a solo 401(k). Self-employment can take any form; however, it does not have to be a full-time business venture.

Any income earned from the side business would be eligible to contribute to a solo 401(k) plan.

The business establishing the solo 401(k) can be structured as a sole proprietorship, partnership, or corporation. One-participant plans are intended for businesses without any employees or businesses with employees who are not eligible to participate in an employer-sponsored plan—for example, those who work fewer than 1,000 hours per year or who are younger than age 21.