Invest now for what you want later.

Proper planning is an important part of making sure you’ll be financially secure throughout retirement.

Take control of your retirement, let us help.

We take everything in your life into account: where you live, your current savings, your income and tax rate, and your spouse’s holdings. Proper planning is an important part of making sure you’ll be financially secure throughout retirement, without the worry of outliving your hard earned income.

Are you saving enough for the future?

How much do I need to retire, should I be saving more? Not an easy question to answer for your ideal retirement. It is important to consider what kind of lifestyle you expect to lead in after your working years.

Do you hope to travel or buy a vacation house?

How often do you want to eat out or go to the movies?

Do you want to move closer to your grandchildren?

Are you on track to reach your goals?

We set portfolio return expectations using risk and goals rather than average return, leading to a better-informed and more personalized outcome.

Don’t wonder if your risk preference will allow you to achieve your goals, We can calculate your probability and build a map for your success.

Personalized

Risk Assessment

Customized retirement plan

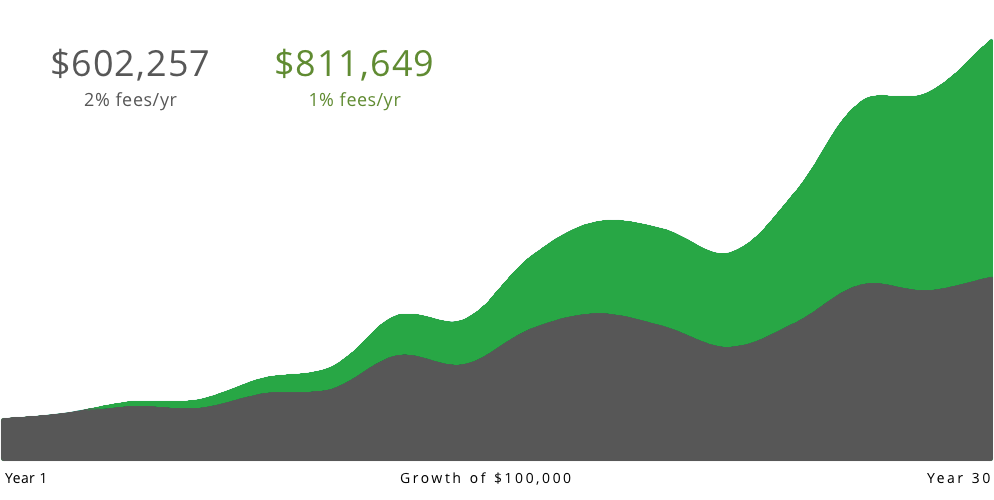

See how fees impact your retirement.

You could be losing hundreds of thousands of dollars in hidden fees in your investing and retirement accounts. 1% less in annual fees over an investment lifetime could mean 10 years longer in retirement.

According to the Department of Labor, a 1% reduction in plan fees could lead to a 28% increase in a participant’s retirement account balance. 1

What does that look like over time?

Rollover or open a new retirement account today.

Answer a few questions so we can match your goals with the appropriate investment plan.